Circular on Issuing the Comprehensive Service Process for Real Estate Registration (Trial)

Document of Shanghai Real Estate Registration Bureau

Shanghai Real Estate Registration Bureau Document No. 10,2018 Issued by Song Wei

—————————————————

Circular on Issuing the Comprehensive Service Process for Real Estate Registration (Trial)

To Shanghai Municipal Real Estate Registration Bureau and district real estate registration centers:

To carry out the “all-round, online and shared” service reform requirements for real estate registration, standardize the real estate transaction, tax payment and comprehensive service process for registration, and instruct each of the districts to do well in the “all-round, online and shared” service reform of real estate, Shanghai Municipal Real Estate Registration Bureau has formulated the Comprehensive Service Process for Real Estate Registration (Trial). It is hereby issued. Please follow it.

Shanghai Municipal Real Estate Registration Bureau

March 16, 2018

Comprehensive Service Process for Real Estate Registration

(Trial)

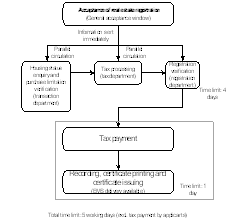

I. Preexamination

The preexamination stand (general information desk) is set by the entrance to the transaction registration hall.

(I) The preexamination stand equipped with

1. Personnel. The preexamination stand can be equipped with 2-4 persons, who will be appointed from the registration and the taxation departments, based on negotiation of such departments.

2. Service application form and sample form, namely, the (1) Application Form for Inquiring Housing Information under the Name of Family Members of Housing Purchaser and (2) Tax Issues on Shanghai Real Estate Transaction for now.

3. Notification on joint processing (as detailed in Appendix 1)

(II) Job requirements for preexamination personnel

1. The registration preexamination personnel are responsible for inquiring about the type of the service the applicant needs, classify it into the comprehensive acceptance or registration acceptance, check if the format and number of the application materials meet the requirements referring to the application materials list, and instruct the applicant to fill in the Application Form for Inquiring Housing Information under the Name of Family Members of Housing Purchaser.

2. The tax preexamination personnel assist in asking the applicant about the tax reduction to be applied for, check the format and number of materials to be submitted and instruct the applicant to fill in the Tax Issues on Shanghai Real Estate Transaction.

3. If time permits, it is suggested that the preexamination personnel assist the applicant in classifying the application materials according to the transaction, taxation, registration, etc.

4. Applicant meeting the requirements and passing the preexamination will be granted the processing number. Applicant failing to meet the requirements will be required to supplement according to relevant requirements.

II. Pre-Acceptance at General Affairs Window/Acceptance at Registration Window

In the case of joint processing of registration and transaction taxes (including transaction and registration joint processing, transaction tax and registration joint processing and tax registration joint processing), the pre-acceptance will be handled by the general affairs window; application involving only registration will be accepted by the registration window.

(I) Pre-acceptance at the general affairs window

1. Personnel. The number of windows is to be determined based on the situation of each of the districts, and the window posts will be taken by the registration staff. In the initial state of joint processing, considering the actual situation, the taxation bureaus of each of the districts should arrange skilled tax officials for support at the acceptance window. And the specified form and persons will be determined subject to discussion of registration and taxation departments of each of the districts based on the actual situation.

2. Job requirements

The registration staff ask the applicant about the application content, check and accept the application materials, and ask the applicant to sign on the registration application form, the EMS details list (if any) and issue the payment bill and pre-acceptance form. After the pre-acceptance, the application materials should be put into the separate bags according to transaction, tax, registration, etc.

The supporting tax officials should coordinate the registration staff to immediately check the forms of the application materials, timely provide the supplement and correction suggestions, and identify application for which the tax affairs can be processed on the spot. For the application for which the tax affairs can be processed on the spot, after the pre-acceptance at the general affairs window, the tax materials bag should be immediately transferred to the tax department (for convenience, it is suggested to set a tax affairs processing window beside the general affairs window), and the applicant should be noticed to pay the tax on the spot. For the application for which the tax affairs cannot be processed on the spot, the tax materials bags will be regularly signed and received by the tax officials.

The transaction materials bag is to be transferred to the housing status enquiry staff according to requirements, which will sign and receive it.

[Note] The in-series processing can be considered for the transaction and registration. Materials bags can be bound and circulated to save the time of materials bags separating. After the online feedback function of the housing status enquiry result is completed, the parallel processing can be realized.

(II) Next stage (scanning and pushing the application materials)

After launching the application material scanning and pushing, the general affairs window receives a material and pushes it after scanning to the transaction tax registration review department with the relevant field information extracted. The paper materials will be filed by the registration department in a unified way.

1. Personnel requirements: Each of the districts designated the full-time personnel (third-party scanning companies) to take charge of the scanning according to the service volume.

2. Job requirements: Relevant personnel should immediately scan the materials after receiving them so as to timely push the information.

III. Review of Housing Status Enquiry

(I) Job requirement for this stage (off-line feedback on housing status enquiry result)

1. After receiving the materials bags, the enquiry personnel should timely enter the information in the housing status enquiry system. For the materials bags received in the morning (or afternoon) should be entered before 12:00 p.m. on the same day (or the afternoon closing time of the same day), so as to conduct the core information comparison by the housing status enquiry at the fixed time (12:00 p.m. and 12:00 a.m.)

2. Issuing the result. The materials bags entered before 12:00 p.m. must be reviewed before the afternoon closing time with result issued. Materials bags entered before the afternoon closing time must be reviewed before the next 12:00 p.m. with result issued. In the case of objections to the result, relevant personnel will try best to handle the affair within 23 hours after receiving the materials.

3. The enquiry personnel print the enquiry result and give the feedback to the registration and tax review department.

(II) Job requirement for the next stage (after the online feedback on housing status enquiry result is started)

1. After receiving the materials bags, the enquiry personnel should enter the information in the housing status enquiry system. For the materials bags received in the morning (or afternoon) should be entered before the morning (or afternoon) service handling time of the same day, so as to conduct the core information comparison by the housing status enquiry system at the fixed time (12:00 p.m. and 12:00 a.m.)

2. Issuing the result. The materials bags entered before 12:00 p.m. must be reviewed before the afternoon closing time with result issued. Materials bags entered before the afternoon closing time must be reviewed before the next 12:00 p.m. with result issued. In the case of objections to the result, relevant personnel will try best to handle the affair within 23 hours since the acceptance.

3. No action by the enquiry personnel is required (the housing status enquiry result will be directly transferred to the registration and tax review department).

IV. Tax Review

(I) Job requirements for the stage (offline feedback on the deed tax payment proof)

1. After the tax officials sign and receive the materials bags, they should finish the back-office treatment within 3 days (excl. the day of receiving the materials bags).

2. The registration department indicates “Please go through tax formalities at the taxation office within 4 working days since the pre-acceptance. The time limit of submitting the deed tax payment proof is the 20th day after the pre-acceptance. For any applicant failing to do so, their application materials will be returned” on the pre-acceptance form. (As detailed in Appendix 2.) After the applicant pays the tax, the tax officials should issue the deed tax payment proof, for the applicant to obtain the real estate ownership certificate.

(II) Job requirements for the next stage (after the online feedback on the deed tax payment proof is started)

1. After the tax officials signing for the materials bags, they should finish the back-office treatment within 3 days (excl. the day of receiving the materials bags).

2. The registration department indicates “Please go through tax formalities at the taxation office within 4 working days since the pre-acceptance. The time limit of submitting the deed tax payment proof is the 20th day after the pre-acceptance. For any applicant failing to do so, their application materials will be returned” on the pre-acceptance form. After the applicant pays the tax, the tax officials need not to issue the deed tax payment proof (the deed tax payment proof will be directly transferred to the registration review department).

V. Registration Review

(I) Personnel requirements

Persons will be designated by each of the districts based on the actual situation.

(II) Job requirements for this stage (final review and recording are not separate)

1. System operation: After the final review, the system will not submit the result. Instead, it waits for the applicant to pay the tax.

2. Materials bags circulating: After the applicant pays the tax and the signal of deed tax payment proof is received from the acceptance window, the deed tax payment is verified without error by the system in the final review. The review result is thus submitted and the materials bag is immediately circulated to the certificate printing personnel.

(III) Job requirements for the next stage (final review and recording are separate)

1. System operation: The system directly submits the review result after the final review is done. The case waits for the deed tax payment signal sent by the taxation office. Only both the “final review is submitted” and “deed tax payment signal is received” conditions are met will the case be recorded in the system. The deed tax verification is done by the system. The review opinion of the final review is changed to be “Approved, waiting for recording after the applicant pays the tax”.

2. Materials bags circulating: After the final review is submitted, the materials bag is circulated to the certificate printing personnel.

VI. Circulating and Supplementing the Application Materials

(I) Circulation the application materials

The application materials are divided into three (or two) materials bags, which should be circulated within half a day after the current work is done, in principle. Each of the districts should, considering the actual situation, increase the circulation frequency, to ensure that other joint departments have adequate time to review.

After launching the application materials scanning and pushing in the next stage, the personnel collect a set of application materials. The paper materials bags will be circulated no more.

(II) Supplement & correction and case returned

1. Personnel requirements: Receiving the materials supplemented or corrected and circulating the bags of materials supplemented or corrected can be in the charge of the original window personnel or the specially designated persons. It can be determined by each of the districts considering the actual situation.

2. Job requirements

After the pre-acceptance, in event that the tax department believes the applicant needing to supplement materials, the tax department is responsible for notifying the applicant for supplement or correct materials timely. After the tax officials indicate the materials to be supplemented or corrected as well as the reasons in the blank section on the pre-acceptance form, the materials bag is to be returned to the real estate registration department via the original circulating route, with handover record made. After the applicant supplements or corrects the materials at the designated window, the window personnel issue the new pre-acceptance form, inform the applicant of the re-calculation of processing timeframe, and timely circulate the materials to the tax department.

In event that the contents to be supplemented or corrected are simple, the contents of the pre-acceptance form need no adjustment. The materials supplemented or corrected will be directly accepted by the tax department, for the convenience of the applicant.

After the application materials scanning and pushing is launched in the next stage, the case is to be returned by the platform, and pushed after the materials supplemented or corrected are scanned.

The materials supplementation or correction at the transaction and registration departments can follow suit.

VII. Certificate Printing

(I) Personnel requirements

Persons will be designated by each of the districts based on the actual situation.

(II) Job requirement for this stage (off-line feedback on housing status enquiry result and deed tax payment proof)

1. Printing: Printing the certificate, proof, check list, etc.

2. Materials bags circulation: After printing the certificate, the materials bags are circulated to the certificate issuing window.

3. Receiving the certificate by EMS delivery: The certificate or proof will be put in envelop of EMS special delivery, and stick the details list onto it.

(III) Job requirement for the next stage (online feedback on housing status enquiry result and deed tax payment proof is launched)

1. Printing: The certificate, proof, check list, housing status enquiry result, deed tax payment proof, etc. will be printed. (As for the results of the housing status enquiry and the deed tax payment proof, each district can arrange to print the certificate during review, based on the actual situation, with the system well supporting the process.)

2. Materials bags circulation: After the certificate is printed, the materials bags are circulated to the certificate issuing window.

3. Receiving certificate by EMS delivery: The certificate or proof is put in envelop of EMS special delivery, and stick the details list onto it.

VIII. Certificate Issuance

(I) Personnel requirements

Persons will be designated by each of the districts based on the actual situation. In this stage, specially designated persons (it is suggested to designate in the certificate issuing window) are in charge of accepting the deed tax payment proof and pre-acceptance form, and inform the final review personnel to submit the case.

(II) Job requirement for this stage (off-line feedback on housing status enquiry result and deed tax payment proof; the final review and recording are not separate)

1. Inform the final review personnel: After accepting the deed tax payment proof and pre-acceptance form, the staff affix the seal “Deed tax payment proof Received”, ask the applicant to sign name on it, and timely inform the final review personnel of the receipt number of materials with duty paid. The materials, after verified by the final review as free of error, will be handed over to the certificate printing window.

2. Materials bag circulation: After the certificate is printed, the materials bag is to be handed over to the certificate issuing window. The certificate issuing personnel issue the certificate (including signing and receiving the certificate receiving form), and put the deed tax payment proof and pre-acceptance form in the materials bag for filing.

3. EMS special delivery: Hand over the EMS special delivery circulated from the certificate printing window to the courier and make sure its receiving.

(III) Job requirement for the next stage (online feedback on housing status enquiry result and deed tax payment proof is launched; the final review and recording are separate)

1. Inform the certificate printing personnel: After taking the pre-acceptance form, check if the certificate is printed. If not, inform the certificate printing personnel to print the certificate and proof of the relevant receipt number.

2. Certificate issuance: The certificate issuing personnel issue the certificate (including signing and receiving the certificate receiving form), and put the pre-acceptance form in the materials bags for filing.

3. EMS special delivery: Hand over the EMS special delivery circulated from the certificate printing window to the courier and make sure its receiving.

IX. Others

(II) Materials returned

After the pre-acceptance, application materials will be returned and the applicant will be informed in the following cases:

1. Illegal occupation of land or sea area;

2. Illegal buildings, temporary buildings of buildings accompanied by illegal buildings;

3. Without valid real estate ownership certificate present;

4. Involving in real estate ownership dispute under lawsuit, arbitration or administrative treatment;

5. Contents of application registration not in line with the records on the real estate register book;

6. Not qualified according to the purchase restriction policy;

7. Failing to submit the deed tax payment proof within the specified time limit;

8. Other cases in which, registration should be rejected even after acceptance according to laws and administrative regulations.

The registration center issues the Notification of Return (as detailed in Appendix 3) and copy and maintain the application materials. The original materials will be returned to the applicant. Since the deed tax payment proof is not submitted and thus not in the acceptance stage, the notification on registration rejection is not needed.

(II) About the special delivery of real estate registration

1. Where the EMS delivery is chosen for taking the real estate ownership certificate (proof), the certificate receiving form is not needed to be printed during the certificate printing stage. At that time, the receiver should directly indicate “Certificate (proof) is received” and sign name on the pre-acceptance form/certificate receiving form.

2. Where the EMS delivery is chosen, it must be signed and received by the receiver personally, with identity certificate and pre-acceptance/certificate receiving evidence submitted. The acceptance personnel should inform the applicant in advance.

3. When deliver, in the case that the pre-acceptance/certificate receiving evidence of the receiver is missing, the courier should send back the real estate ownership certificate (proof) to the address on the reverse details list, and send to the registration department the next day which mails in the first place. The receiver should personally go through the certificate receiving formalities at the registration department.

X. Date of Enforcement

Regulations above will be effective since March 16, 2018, and valid until March 15, 2020.

Appendix: 1. Notification on General Acceptance of Real Estate Transaction Tax Registration

2. General Pre-acceptance Form for Real Estate Transaction Tax Registration in Shanghai

3. Notification of Return

Appendix 1-1

| Notification on General Acceptance of Real Estate Transaction Tax Registration |

|

|

||||||

| [Individuals buying new commercial housing] |

|

|

||||||

|

Registration type |

Individuals buying new commodity housing (including pre-write-off) Standard acceptance |

Following materials needed if applicant covers house mates owning no housing |

Following materials needed if applicants applying for house-purchase tax credits are not Shanghai residents |

Following materials needed if housing buyers are not Shanghai residents |

Following materials needed if applying for housing tax for new housing purchase by grown-up children |

Following materials needed if applying for house-purchase tax credits while selling the sold housing |

|

Notes

|

| Submission of materials |

|

|||||||

| Shanghai Real Estate Registration Application Form (Original Copy) |

1 |

|

|

|

|

|

|

|

| Tax Issues on Shanghai Real Estate Transaction (original copy) |

1 |

|

|

|

|

|

|

|

| Application Form for Inquiring Housing Information under the Name of Family Members of Housing Purchaser (original copy) |

1 |

|

|

|

|

|

|

|

| Identity certificate of housing purchaser (copy) |

3 |

|

|

|

|

|

|

|

| Identity certificate of family members of housing purchaser (copy) |

2 |

|

|

|

|

|

|

|

| Census register (or residence) certificate of housing purchaser and family members (copy) |

2 |

|

|

|

|

|

|

|

| Marital status (or residence) certificate of housing purchaser and family members (copy) |

2 |

|

|

|

|

|

|

|

| Identity certificate of real estate development enterprise the seller (copy) |

1 |

|

|

|

|

|

|

|

| Power of attorney (original copy) and identity certificate of agent (copy) |

With an agent, 3 copies |

|

|

|

|

|

|

|

| House-purchase invoice (copy) |

1 |

|

|

|

|

|

|

|

| Pre-sale contract of commodity housing (advance-notice registration certificate) and housing handover certificate |

(Choose 1 from the 2) |

|

|

|

|

|

|

|

|

|

||||||||

| Contract of sales of commercial residential building |

|

|||||||

| Voucher of maintenance fund payment (original copy) |

1 |

|

|

|

|

|

|

|

| Supply bill of settlement building (original copy) |

1 (Presenting in the case of settlement building) |

|

|

|

|

|

|

|

| Identity, resident and marital status certificates of people living together without housing and their families (copy) |

|

1 |

|

|

|

|

|

|

| Domestic relation certificate between the people living together without housing and the applicant (copy) |

|

1 |

|

|

|

|

|

|

| Residence Permit of Shanghai, notice on credits of residence permit (copy) |

|

|

Period of validity of Shanghai Residence Permit is more than 3 years or the credits have reached the standards. 1 |

(Choose 1 from the 4) |

|

|

|

|

| Temporary Residence Permit for Hong Kong and Macao Residents in Shanghai (copy) |

|

|

|

|

||||

| Residence visa issued in Shanghai (copy) |

|

|

|

|

||||

| Residence permit issued in Shanghai (copy) |

|

|

|

|

||||

| Duty-paid proof for social security or individual income tax (original) |

|

|

|

1 |

|

|

|

|

| Residence booklet of parents of the housing purchase in this city (copy) |

|

|

|

|

1 |

|

|

|

| Domestic relation certificate between the housing purchaser and his or her parents (copy) |

|

|

|

|

1 |

|

||

| Sales Contract of Public Housing, Special Voucher for Income from Selling Public Housing in Shanghai (copy) |

|

|

|

|

|

1 |

|

|

| Real estate transaction contract, invoice upon sales of public housing (accounting voucher) (copy) |

|

|

|

|

|

1 |

|

|

| Register book of public housing sold (original copy) or property ownership certificate of the purchaser (copy) |

|

|

|

|

|

1 |

|

|

| Identity and domestic relation certificates of the original public housing owner, in event that the housing purchaser is the mate, parent or child of the original public housing owner (copy) |

|

|

|

|

|

1 |

|

|

| Note: When the applicant submitting the copies, the original copies should be provided for verification. |

|

|

|

|

|

|

|

|

Appendix 1-2

| Notification on General Acceptance of Real Estate Transaction Tax Registration |

|

|

|||||||||

|

|

|

|

|||||||||

|

|

Stock housing transaction (sold by individuals selling and bought by individuals) |

Following materials needed if applicant covers house mates owning no housing |

Following materials needed if applicants applying for house-purchase tax credits are not Shanghai resident |

Following materials needed if housing buyers are not Shanghai residents |

Following materials needed if applying for housing tax for new housing purchase by grown-up children |

Following materials needed if applying for house-purchase tax credits while selling the sold housing |

Following materials needed if individual income tax levied subject to verification |

Following materials needed if housing sold is new commodity housing |

|

Notes

|

|

| Materials submission |

|

||||||||||

| Shanghai Real Estate Registration Application Form (original copy) |

1 |

|

|

|

|

|

|

|

|

||

| Tax Issues on Shanghai Real Estate Transaction (original copy) |

1 |

|

|

|

|

|

|

|

|

||

| Application Form for Inquiring Housing Information in the Name of Family Members of Housing Purchaser (original copy) |

1 |

|

|

|

|

|

|

|

|

||

| Identity certificate of housing purchaser (copy) |

3 |

|

|

|

|

|

|

|

|

||

| Identity certificate of family members of housing purchaser (copy) |

2 |

|

|

|

|

|

|

|

|

||

| Census register (or residence) certificate of housing purchaser and family members (copy) |

2 |

|

|

|

|

|

|

|

|

||

| Marital status (or residence) certificate of housing purchaser and family members (copy) |

2 |

|

|

|

|

|

|

|

|

||

| Identity certificate of housing seller (copy) |

2 |

|

|

|

|

|

|

|

|

||

| Power of attorney (original copy) and identity certificate of agent (copy) |

With an agent, 3 copies |

|

|

|

|

|

|

|

|

||

| Property Ownership Certificate (including real estate ownership certificate and certificate of house ownership) |

1 original copy |

|

|

|

|

|

|

|

|

||

| Opinions on Enquiry on Real Estate Transaction Price or evaluation report (including technical report) (original copy) |

1 |

|

|

|

|

|

|

|

|

||

| Original house-purchase invoice (for use at deduction), contact and deed tax related vouchers (copies) of the seller |

1 |

|

|

|

|

|

|

|

|

||

| Real estate transaction contract |

1 original copy |

|

|

|

|

|

|

|

|

||

| Identity, resident and marital status certificates of people living together without housing and their families (copy) |

|

1 |

|

|

|

|

|

|

|

||

| Domestic relation certificate between the people living together without housing and the applicant (copy) |

|

1 |

|

|

|

|

|

|

|

||

| Residence Permit of Shanghai, notice on credits of residence permit (copy) |

|

|

Period of validity of Shanghai Residence Permit is more than 3 years or the credits have reached the standards. 1 |

(Choose 1 from the 4) |

|

|

|

|

|

||

| Temporary Residence Permit for Hong Kong and Macao Residents in Shanghai (copy) |

|

|

|

|

|||||||

| Residence visa issued in Shanghai (copy) |

|

|

|

|

|||||||

| Residence permit issued in Shanghai (copy) |

|

|

|

|

|||||||

| Duty-paid proof for social security or individual income tax (original) |

|

|

|

1 |

|

|

|

|

|

||

| Residence booklet of parents of the housing purchase in this city (copy) |

|

|

|

|

1 |

|

|

|

|

||

| Domestic relation certificate between the housing purchaser and his or her parents (copy) |

|

|

|

|

1 |

|

|

|

|

||

| Sales Contract of Public Housing, Special Voucher for Income from Selling Public Housing in Shanghai (copy) |

|

|

|

|

|

1 |

|

|

|

||

| Real estate transaction contract, invoice upon sales of public housing (accounting voucher) (copy) |

|

|

|

|

|

1 |

|

|

|

||

| Register book of public housing sold (original copy) or property ownership certificate of the purchaser (copy) |

|

|

|

|

|

1 |

|

|

|

||

| Identity and domestic relation certificates of the original public housing owner, in event that the housing purchaser is the mate, parent or child of the original public housing owner (copy) |

|

|

|

|

|

1 |

|

|

|

||

| Invoices of housing decoration fees (including lists), mortgage loan contracts and loan interest settlement lists with the bank, vouchers of service charges and notarial fees actually paid during housing transfer, and tax receipts (copy) |

|

|

|

|

|

|

1 |

|

|

||

| Housing handover certificate (copy) |

|

|

|

|

|

|

|

1 |

|

||

| Note: When the applicant submitting the copies, the original copies should be provided for verification. |

|

|

|

|

|

|

|

|

|

||

Appendix 1-3

| Notification on General Acceptance of Real Estate Transaction Tax Registration |

|

|

|||||||

| [Transaction of stock non-residence housing and residence housing (sold by institutions and bought by institutions), institutions buying new commodity housings, individuals buying new non-residence housings, housings of common property right, public housings] |

|

|

|||||||

|

|

Institutions buying new commodity housings(including pre-write-off) |

Individuals buying new non-residence housings(including pre-write-off) |

Individuals buying indemnificatory housing of common property right(including pre-write-off) |

Transaction of stock housings (sold by institutions and bought by institutions) |

Transaction of non-residence housings (sold by institutions) |

Transaction of non-residence housings (Sold by individuals) |

Individuals buying public housings |

|

Notes |

| Materials submission |

|

||||||||

| Shanghai Real Estate Registration Application Form (original copy) |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

|

|

| Tax Issues on Shanghai Real Estate Transaction (original copy) |

1 |

1 |

1 |

1 |

1 |

1 |

1 |

|

|

| Identity certificate of housing purchaser (copy) |

2 |

2 |

2 |

2 |

2 |

2 |

2 |

|

|

| Identity certificate of housing seller (copy) |

1 |

1 |

1 |

2 |

2 |

2 |

1 |

|

|

| Power of attorney (original copy) and identity certificate of agent (copy) |

With an agent, 2 copies |

With an agent, 2 copies |

With an agent, 2 copies |

With an agent, 2 copies |

With an agent, 2 copies |

With an agent, 2 copies |

With an agent, 2 copies |

|

|

| House-purchase invoice (copy) |

1 |

1 |

1 |

|

|

|

|

|

|

| Pre-sale contract of commodity housing (advance-notice registration certificate) and housing handover certificate |

(Choose 1 from the 2) |

(Choose 1 from the 2) |

(Choose 1 from the 2) |

|

|

|

|

|

|

| Contract of sales commodity housings or real estate transaction contract |

1 original copy |

1 original copy |

|

|

|

||||

| Voucher of maintenance fund payment (original copy) |

1 |

1 |

1 |

|

|

|

|

|

|

| Property Ownership Certificate (including real estate ownership certificate and certificate of house ownership) |

|

|

|

1 original copy |

1 original copy |

1 original copy |

|

|

|

| Opinions on Enquiry on Real Estate Transaction Price or evaluation report (including technical report) (original copy) |

|

|

|

1 |

1 |

1 |

|

|

|

| VAT invoices (copy) |

|

|

|

1 |

1 |

|

|

|

|

| Original house-purchase invoice, contact and deed tax related vouchers (copies) of the seller |

|

|

|

1 |

1 |

1 |

|

||

| Evaluation report on real estate replacement costs issued by qualified evaluation firms (including technical reports) (copy) |

|

|

|

If the seller is a Shanghai-based institution and the housing traded is self-built or without original purchase invoice, 1 copy is need. |

If the seller is a Shanghai-based institution and the housing traded is self-built or without original purchase invoice, 1 copy is need. |

|

|

||

| Identity certificate of family members of housing purchaser (copy) |

|

|

In the case of buying the only economically affordable housing not larger than 90 square meters, 1 copy is needed. |

|

|

|

|

||

| Marital status certificate of housing purchaser and family members (copy) |

|

|

|

|

|

|

|

||

| Contract of sales of public housing and voucher of housing payment |

|

|

|

|

|

|

1 original copy |

|

|

| Computation sheets for trading values of public housing and for payment by housing purchasers |

|

|

|

|

|

|

1 original copy |

|

|

| Housing deployment form (copy) |

|

|

|

|

|

|

1 |

|

|

| Note: When the applicant submitting the copies, the original copies should be provided for verification. |

|

|

|

|

|

|

|

|

|

Appendix 1-4

Notification on General Acceptance of Real Estate Transaction Tax Registration |

|

|

|||||||

| [Stock housing transaction (sold by institutions and bought by individuals)] |

|

|

|||||||

|

|

Stock housing transaction (sold by institutions and bought by individuals) |

Following materials needed if the seller is not Shanghai-based and housing sold is self-built or without original purchase invoice |

Following materials needed if applicant covers house mates owning no housing |

Following materials needed if applicants applying for house-purchase tax credits are not Shanghai residents |

Following materials needed if housing buyers are not Shanghai residents |

Following materials needed if applying for housing tax for new housing purchase by grown-up children |

Following materials needed if applying for house-purchase tax credits while selling the sold housing |

|

Notes I Power of attorney

|

| Materials submission |

|

||||||||

| Shanghai Real Estate Registration Application Form (Original Copy) |

1 |

|

|

|

|

|

|

|

|

| Tax Issues on Shanghai Real Estate Transaction (original copy) |

1 |

|

|

|

|

|

|

|

|

| Application Form for Inquiring Housing Information under the Name of Family Members of Housing Purchaser (original copy) |

1 |

|

|

|

|

|

|

|

|

| Identity certificate of housing purchaser (copy) |

3 |

|

|

|

|

|

|

|

|

| Identity certificate of family members of housing purchaser (copy) |

2 |

|

|

|

|

|

|

|

|

| Census register (or residence) certificate of housing purchaser and family members (copy) |

2 |

|

|

|

|

|

|

|

|

| Marital status (or residence) certificate of housing purchaser and family members (copy) |

2 |

|

|

|

|

|

|

|

|

| Identity certificate of housing seller (copy) |

2 |

|

|

|

|

|

|

|

|

| Power of attorney (original copy) and identity certificate of agent (copy) |

With an agent, 3 copies |

|

|

|

|

|

|

|

|

| Property Ownership Certificate (including real estate ownership certificate and certificate of house ownership) |

1 original copy |

|

|

|

|

|

|

|

|

| Opinions on Enquiry on Real Estate Transaction Price or evaluation report (including technical report) (original copy) |

1 |

|

|

|

|

|

|

|

|

| VAT invoices (copy) |

1 |

|

|

|

|

|

|

|

|

| Original house-purchase invoice (for use at deduction), contact and deed tax related vouchers (copies) of the seller |

1 |

|

|

|

|

|

|

|

|

| Real estate transaction contract |

1 original copy |

|

|

|

|

|

|

|

|

| Evaluation report on real estate replacement costs issued by qualified evaluation firms (including technical reports) (copy) |

|

1 |

|

|

|

|

|

|

|

| Identity, resident and marital status certificates of people living together without housing and their families (copy) |

|

|

1 |

|

|

|

|

|

|

| Domestic relation certificate between the people living together without housing and the applicant (copy) |

|

|

1 |

|

|

|

|

|

|

| Residence Permit of Shanghai, notice on credits of residence permit (copy) |

|

|

|

Period of validity of Shanghai Residence Permit is more than 3 years or the credits have reached the standards.1 |

(Choose 1 from the 4) |

|

|

|

|

| Temporary Residence Permit for Hong Kong and Macao Residents in Shanghai (copy) |

|

|

|

|

|

||||

| Residence visa issued in Shanghai (copy) |

|

|

|

|

|

||||

| Residence permit issued in Shanghai (copy) |

|

|

|

|

|

||||

| Duty-paid proof for social security or individual income tax (original) |

|

|

|

|

1 |

|

|

|

|

| Residence booklet of parents of the housing purchase in this city (copy) |

|

|

|

|

|

1 |

|

|

|

| Domestic relation certificate between the housing purchaser and his or her parents (copy) |

|

|

|

|

|

1 |

|

|

|

| Sales Contract of Public Housing, Special Voucher for Income from Selling Public Housing in Shanghai (copy) |

|

|

|

|

|

|

1 |

|

|

| Real estate transaction contract, invoice upon sales of public housing (accounting voucher) (copy) |

|

|

|

|

|

|

1 |

|

|

| Register book of public housing sold (original copy) or property ownership certificate of the purchaser (copy) |

|

|

|

|

|

|

1 |

|

|

| Identity and domestic relation certificates of the original public housing owner, in event that the housing purchaser is the mate, parent or child of the original public housing owner (copy) |

|

|

|

|

|

|

1 |

|

|

| Note: When the applicant submitting the copies, the original copies should be provided for verification. |

|

|

|

|

|

|

|

|

|

Appendix 1-5

Notification on General Acceptance of Real Estate Transaction Tax Registration |

|

|

||||

|

|

|

|

||||

|

|

Transaction of stock housings (Sold by individuals and bought by institutions) |

Following materials needed if individual income tax levied subject to verification |

Following materials needed if housing sold is new commodity housing |

|

Notes |

|

| Materials submission |

|

|||||

| Shanghai Real Estate Registration Application Form (original copy) |

1 |

|

|

|

||

| Tax Issues on Shanghai Real Estate Transaction (original copy) |

1 |

|

|

|

||

| Identity certificate of housing purchaser (copy) |

2 |

|

|

|

||

| Identity certificate of housing seller (copy) |

2 |

|

|

|

||

| Power of attorney (original copy) and identity certificate of agent (copy) |

With an agent, 2 copies |

|

|

|

||

| Property Ownership Certificate (including real estate ownership certificate and certificate of house ownership) |

1 original copy |

|

|

|

||

| Opinions on Enquiry on Real Estate Transaction Price or evaluation report (including technical report) (original copy) |

1 |

|

|

|

||

| Original house-purchase invoice (for use at deduction), contact and deed tax related vouchers (copies) of the seller |

1 |

|

|

|

||

| Real estate transaction contract |

1 original copy |

|

|

|

||

| Invoices of housing decoration fees (including lists), mortgage loan contracts and loan interest settlement lists with the bank, vouchers of service charges and notarial fees actually paid during housing transfer, and tax receipts (copy) |

|

1 |

|

|

||

| Housing handover certificate (copy) |

|

|

1 |

|

||

| Note: When the applicant submitting the copies, the original copies should be provided for verification. |

|

|

|

|

||

Appendix 2

General Pre-acceptance Form for Real Estate Transaction Tax Registration in Shanghai

| Registration type: |

Bar code for receipt number |

| Receipt number: |

|

| Application obligee: |

|

Contact number: |

| Application obligator: |

|

|

| Location of real estate: |

|

|

| Acceptance department |

Name of file |

Original copy/copy |

Number of copy |

remark |

| Receipt registration |

|

|

|

|

|

|

|

|

|

|

| Tax related materials received |

|

|

|

|

|

|

|

|

|

|

| Materials of real estate status query received |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

Received by: |

Tel.: |

||

| Address of real estate registration center: |

|

| Received on: |

|

| Notes: |

|

| 1. After the applicant passes the purchase limitation review and pays the tax, the real estate registration department commits that the registration is to be finished within 5 working days (excl. tax payment) since the date of issuing the pre-acceptance form. 2. If materials should be supplemented, the notice on supplement will be issued separately, and the pre-acceptance date for it should be calculated since the date of materials supplemented. 3. Formalities for receiving the certificate: When receiving the certificate, the applicant should present the pre-acceptance form and identity certificate (original copy). In the case of trustee, the trustee should present the pre-acceptance form, power of attorney (with signature and seal), identity certificate of the mandatory (copy), and identity certificate of the trustee (original copy and copy). Where the agent (trustee) for receiving the certificate is already stated, the trustee should be the one recorded in the certificate receiving statement. In the case of certificates held separately, all certificates should be received once. 4. The applicant should conclude the tax affairs at the taxation office 4 working days after the pre-acceptance. The time limit is the 20th day after the pre-acceptance. To applicants failing to do so, the application materials will be returned. 5. The date on which the deed tax payment proof is handed over to the real estate registration department is the registration acceptance date. 6. Where the obligee has objections to the contents of real estate registration or registration certificate, he or she can apply for administrative review within 60 days or file an administrative law suit to the people's court within six months after the date of certificate receiving. |

|

|

|

|

| Application obligee |

|

Application obligator |

|

|

|

(Signature) |

|

(Signature) |

| Or agent |

|

Or agent |

|

Appendix 3

Notification of Return

______________________:

You (your institution) submitted the materials on DD/MM/YY. The general pre-acceptance number is:________________. The application materials is now returned for the No.____problem is existing, which makes it unable to proceed the processing. Please take your materials back with this notification, identity certificate and pre-acceptance form.

I. Illegal occupation of land or sea area;

II. Illegal buildings, temporary buildings of buildings accompanied by illegal buildings;

III. Without valid real estate ownership certificate present;

IV. Involving in real estate ownership dispute under lawsuit, arbitration or administrative treatment;

V. Contents of application registration not in line with the records on the real estate register book;

VI. Not qualified according to the purchase restriction policy;

VII. Failure to conclude the tax affairs within time limit.

VIII. ___________________________________________________

_________Real Estate Registration Center

DD/MM/YY

| Reported to: Shanghai Municipal Bureau of Planning and Land Resources, Shanghai Municipal Commission of Housing and Urban-rural Development, Shanghai Real Estate Administration, Shanghai Municipal Bureau of Local Taxation, district people’s governments Forwarded to: district bureau of planning and land resources, real estate administration, local taxation bureau, real estate transaction center, tax office stationed in real estate transaction center |

|

| Shanghai Real Estate Registration Bureau |

Printed on March 16, 2018 |